Automate Onboarding, Offboarding, and Role Changes: Reduce IT & HR Workload by 70% and Eliminate Security Gaps

Watch Our Employee Lifecycle Management Solution in Action

Watch our employee lifecycle management in action with Hire2Retire

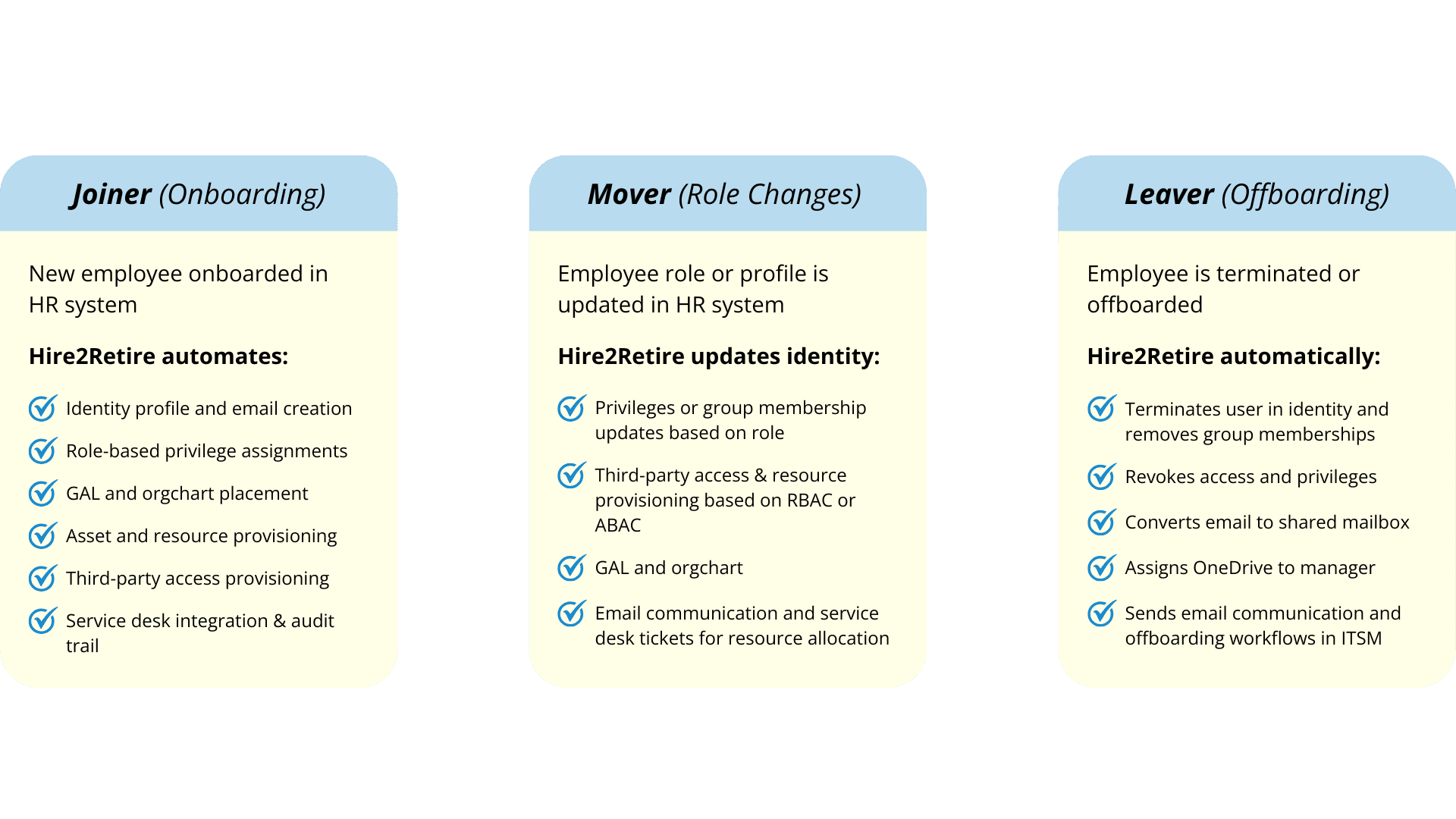

Automate JML Processes With Hire2Retire HR to IdP Integration

Automate Joiner, Mover, Leaver to Identity

Trusted by Leading Companies

These are some of the leading companies that have trusted RoboMQ to solve their HR system integration needs to accelerate digital transformation and create competitive advantages.

These are some of the leading companies that have trusted RoboMQ to solve their HR system integration needs to accelerate digital transformation and create competitive advantages.

Top Rated Employee Lifecycle Management and Identity Governance Platform

Powerful Lightweight IGA platform with Data, ITSM & HR System Integration

Identity, Governance and Administration (IGA) with strong API and Data Integration capabilities from a leading iPaaS company at a fraction of the cost.

Choose your HCM platform to integrate with AD or Azure AD

RoboMQ is not affiliated, associated, authorized, endorsed by, or in any way officially connected with any of the HR systems. All product and company names are the registered trademarks of their original owners. The use of any trade name or trademark is for identification and reference purposes only and does not imply any association with the trademark holder of their product brand.

Choose your HCM platform to integrate with AD or Azure AD

RoboMQ is not affiliated, associated, authorized, endorsed by, or in any way officially connected with any of the HR systems. All product and company names are the registered trademarks of their original owners.

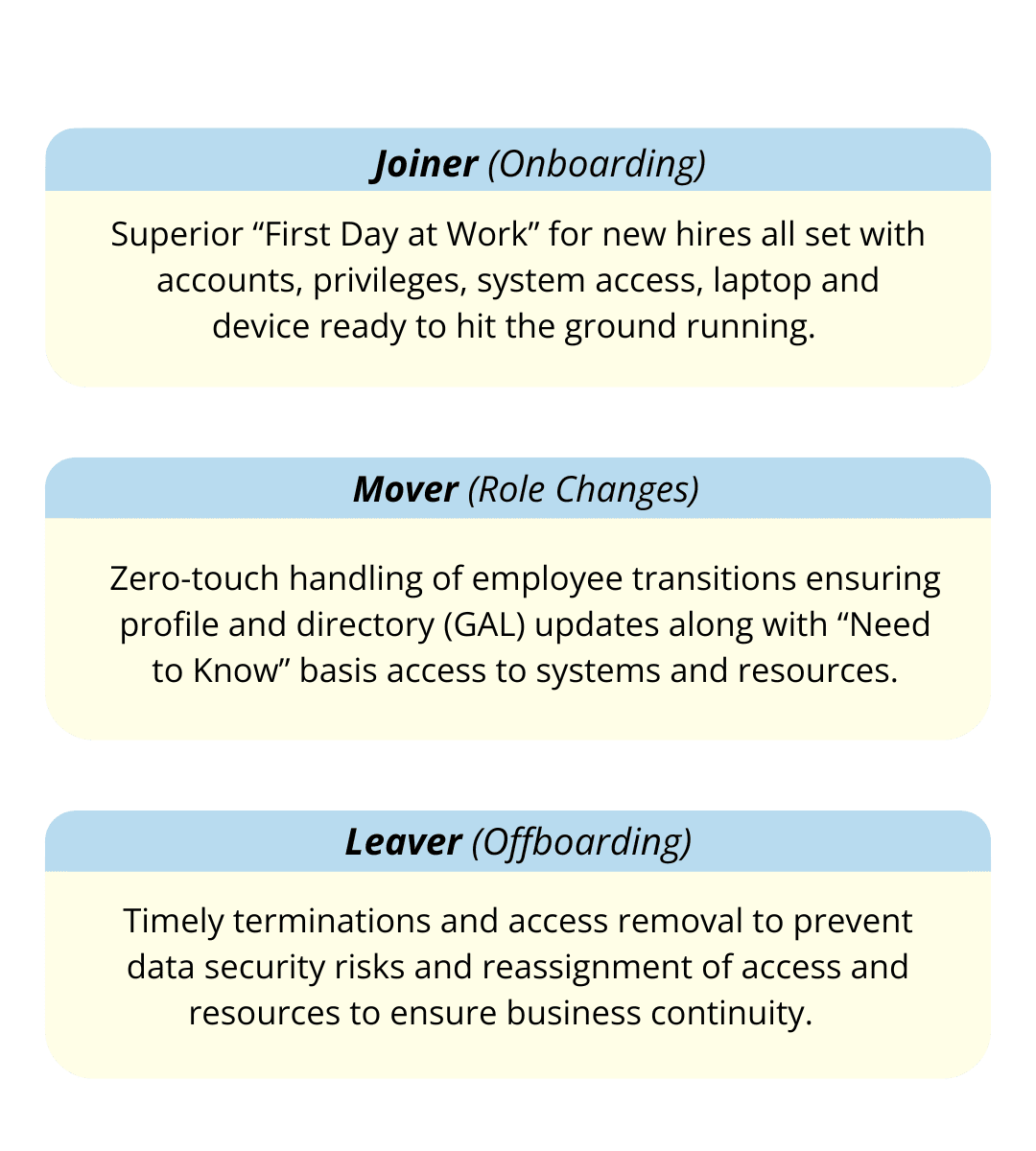

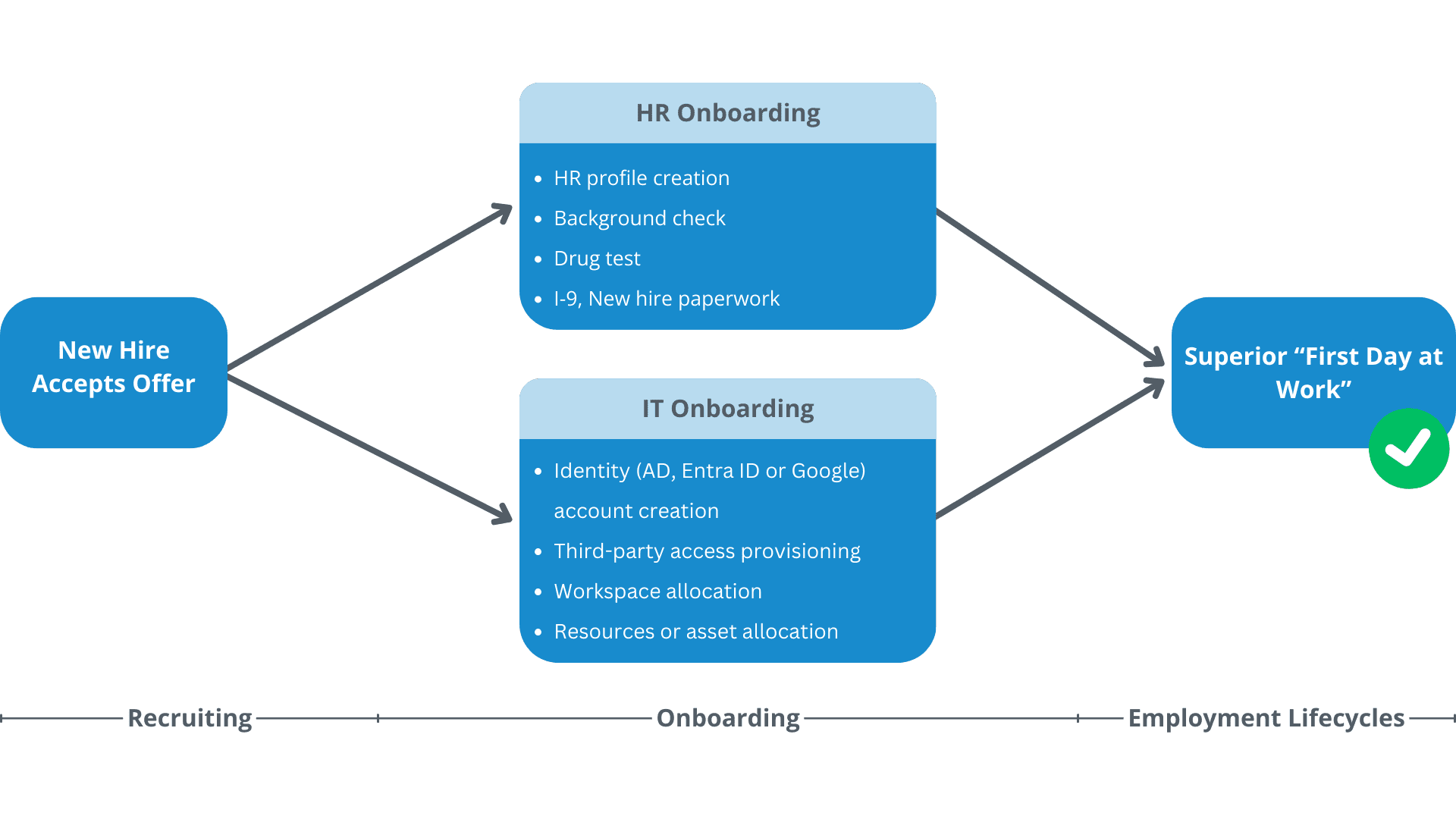

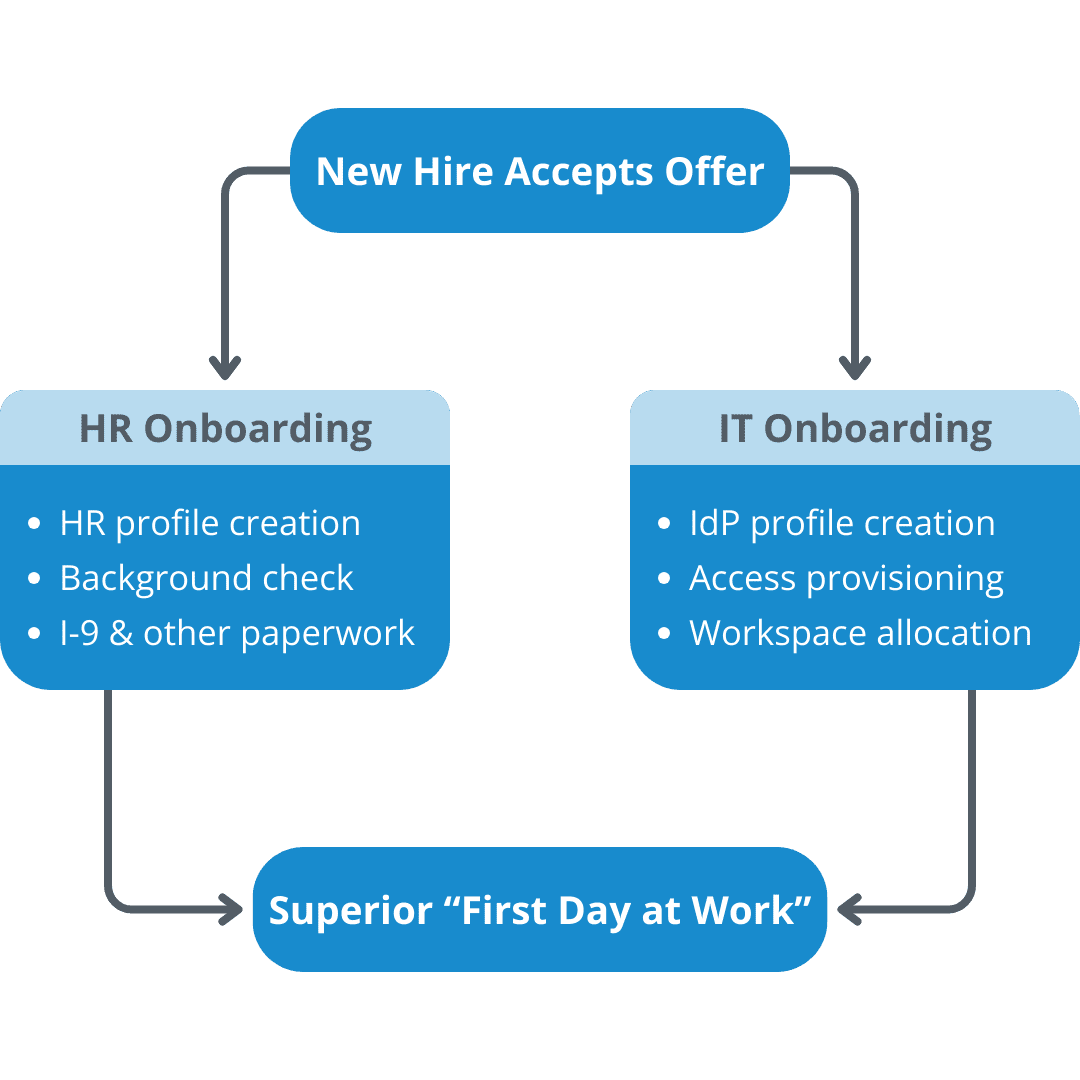

Automated Employee Onboarding for a Superior "First Day at Work"

Upon offer acceptance, while new hires are getting onboarded by HR, IT can, in parallel, get the account created and prepare and ship the laptop or devices so that the employee is ready for work on Day One!

Automated Onboarding for a Superior "First Day at Work"

Why Hire2Retire for Employee Onboarding, Offboarding, and Transitions?

Leading companies use Hire2Retire to sync HR systems with Identity Providers (IdP) to manage employee identity lifecycle and enable zero-touch privileges, access, and resource provisioning

Leading companies use Hire2Retire to sync HR systems with Identity Providers (IdP) to manage employee identity lifecycle and enable zero-touch privileges, access, and resource provisioning

Superior “First Day at Work” experience

Superior “First Day at Work” experience

90% or more cost avoidance

90% or more cost avoidance

Role-based access and privileges

Role-based access and privileges

Timely terminations to prevent security risks

Timely terminations to prevent security risks

Security and Compliance with SOC2, HIPAA, ISO 27001

Security and Compliance with SOC2, HIPAA, ISO 27001

Hear from our Customers

Ready to see Employee Identity Lifecycle Automation in Action?

Automate onboarding and offboarding with Hire2Retire integration. Manage profile changes from HR to Identity effortlessly while ensuring “need to know” basis access privileges to prevent cyber security and reputation risks.